Configuration

Quickbooks Settings

QuickBooks Accounts

In QuickBooks, create a new Sales Tax Item, with Type "Service". Name it "SCPS Sales Tax" or whatever you like. Select a Tax Agency vendor (e.g., Wisconsin Dept of Revenue) for this new tax account and leave the tax rate blank. Tax Code should be set to "Non" (US version) or "E" (Canadian version).Several account names must be registered in SCPS for proper QuickBooks integration. Make note of the accounts your company uses for the following:

- Sales

- Inventory

- Cost of Goods

- Sales Tax (described above)

These account names will be added to SCPS as described below.

SCPS Settings

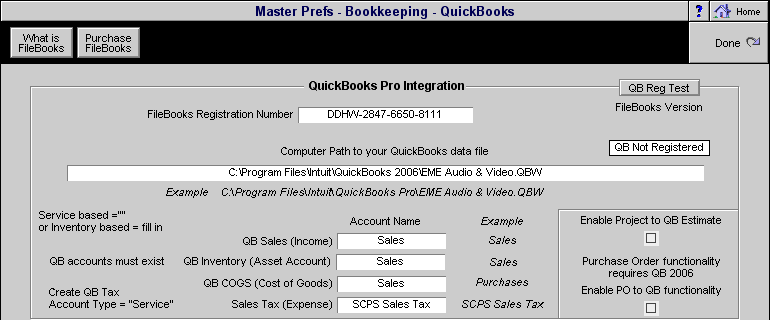

Enter your FileBooks registration code (FileBooks provides this via email) on the SCPS>Preferences>Bookkeeping>QuickBooks screen pictured below.Enter the computer path to your QuickBooks data file. Example: C:\Program Files\Intuit\QuickBooks\MyCompanyFile.qbw

Enter the exact names of the QuickBooks accounts your company uses for Sales, Inventory, COGS and Sales Tax, as noted in the "QuickBooks Accounts" section above.

Check "Enable Project to QB Estimate" if you want to create QuickBooks estimates from SCPS.

Check "Enable PO to QB functionality" if you want to create QuickBooks PO's from SCPS.

-

Note:

- Quickbooks integration works with SCPS Invoices and PO's in Projects, but does not currently work with the SCPS POS module.

SCPS QuickBooks Prefs Screen